Table of Contents

Choosing the right game business model has become one of the most defining decisions for modern studios. In 2024, more than 70% of the global game industry’s $184+ billion revenue came from titles operating under long-tail business models such as GaaS, Early Access, and ecosystem-driven development. Meanwhile, over 68% of mobile studios report that shifting their game development business model – not just monetization – had the biggest impact on production velocity and launch success.

These shifts reflect an industry where development structure, content cadence, and LiveOps readiness increasingly determine a game’s sustainability. Whether a team is building a premium console title, scaling a service-based mobile game, or exploring a new business model for mobile games, choosing the right development framework influences budgets, staffing, timelines, and long-term viability.

This guide breaks down the major game development business models studios use today, focusing on how games are built, supported, and sustained throughout their lifecycle. While monetization strategies like in-game purchases and subscriptions are crucial, they are covered in a dedicated game monetization guide to keep this discussion focused on the production and operational frameworks.

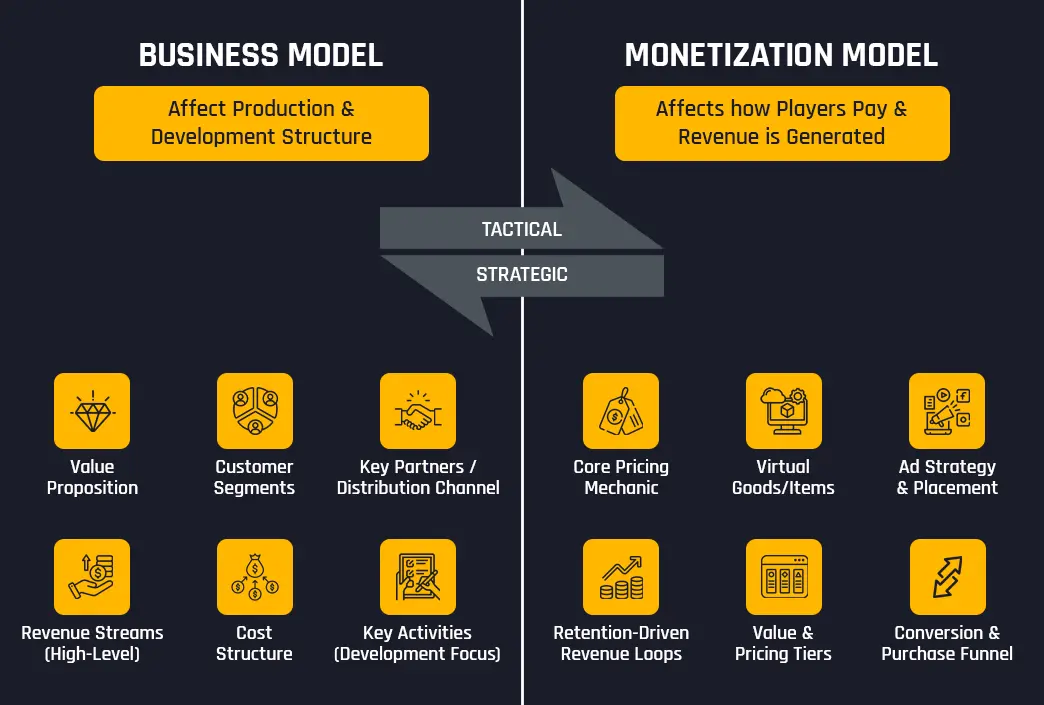

A game business model defines how a game is built, produced, launched, and supported over its lifecycle. It guides decisions around team structure, technology, budgets, content cadence, and LiveOps readiness long before monetization strategies come into play.

The State of Mobile Gaming 2024 Report by data.ai states that more than 65% of studios reported that choosing the right development model had a greater impact on launch success than monetization design itself. This reflects a shift in how modern teams plan production: the game development business model now shapes whether a project can scale, hit milestones, and sustain long-term updates.

In contrast to a business model, a monetization model defines how the game earns revenue once players experience it. This includes pricing, in-game purchases, ad strategy, subscriptions, hybrid systems, and retention-driven revenue loops.

Below are the most widely adopted game development business models across mobile, PC, console, and cross-platform production.

The premium model revolves around a one-time purchase, making production quality and launch readiness critical. Titles like Elden Ring, God of War Ragnarök, and Hades exemplify this model, where high production value and a polished 1.0 release drive success.

Studios building premium titles often prefer full-cycle game development services because consistent engineering, game art quality, and unified pipelines are essential for delivering a seamless final product.

The GaaS model is seen as one of the best business models for games requiring long-term engagement. Successful examples include Fortnite, Genshin Impact, and Apex Legends, all of which rely on continuous content updates, seasonal events, and strong LiveOps pipelines.

Teams scaling GaaS titles often turn to game co-development to scale feature production, run events, or accelerate art pipelines while internal teams focus on core systems and product vision.

Early Access allows a studio to release an in-progress build and iterate with community feedback. Games like Baldur’s Gate 3, Hades (early access phase), and Subnautica refined their mechanics, UI, and content through player-driven updates before full launch.

Teams often rely on full-cycle development support or selective co-dev for engineering, game art, and optimization to maintain frequent update milestones while preparing for a 1.0 release.

This model delivers the game in structured episodes or chapters. Popular examples include Life is Strange, Telltale’s The Walking Dead, and Kentucky Route Zero.

Episodic development pairs well with external art and engineering support because co-development enables parallel creation of future chapters while the internal team polishes earlier releases. Narrative planning, asset continuity, and production cadence are central to this approach.

Ecosystem platforms offer built-in audiences and clear revenue-share structures. Successful titles include Adopt Me! on Roblox, OnlyUp! UEFN Edition, and numerous creator-led experiences in Meta’s Horizon Worlds.

The game development business model here centers on rapid iteration, user-generated content loops, and constant updates. Hybrid pipelines – combining internal oversight with external co-dev – boost content velocity. Studios hire 3D artists to support their teams by producing stylized assets optimized for each platform’s constraints.

Crowdfunding finances early development through community support. Games like Star Citizen, Shovel Knight, and Pillars of Eternity exemplify this model. Because backers expect regular updates, this approach benefits from structured workflows and predictable milestone delivery.

Teams may use external partners for full-cycle development of core systems or specialized needs like concept art, trailers, prototyping, or optimization.

Under this model, the publisher funds development and may support marketing, QA, distribution, or LiveOps. Major releases like Destiny, Call of Duty, and Alan Wake 2 were built under publisher-funded structures.

This model requires strict milestone delivery, where co-development and full-cycle development provide scalability and predictability. An external game art studio can also help maintain consistency across multiple platforms.

The hybrid model is one of the best business models for games requiring scalability and rapid iteration. Large franchises like Assassin’s Creed, Call of Duty, and Halo Infinite regularly use a combination of internal direction and external co-development studios across art, engineering, systems design, and LiveOps support.

This blended pipeline allows internal teams to focus on high-impact creative decisions while game development outsourcing partners handle volume-heavy production tasks.

A game business model directly shapes how a project is staffed, scheduled, funded, and supported after launch. In a market where development timelines continue to grow, studios face more production pressure than ever. At the same time, production costs for mid-core and AAA titles have risen sharply over the last decade.

AAA budgets that once averaged $100–200 million in the early 2010s now often reach $300–600 million or more, driven by larger teams, expanded content scopes, and extended 6-10+ year development cycles.

With stakes this high, studios can’t afford structural inefficiencies.

A well-defined game development business model influences:

Studios must determine whether internal teams can manage full production or whether co-development and scalable art/engineering support are required to hit key milestones.

Different models – Premium, GaaS, Early Access, Hybrid – have radically different cost curves. Premium titles front-load cost, while GaaS and ecosystem games distribute investment across LiveOps, updates, and content cycles.

Business models determine engine choices, cross-platform requirements, backend infrastructure, and the long-term need for optimization or porting.

Service-driven games require continuous content, monitoring, and tuning. Studios often bring in LiveOps specialists or external partners to sustain cadence.

Many studios now blend internal direction with full-cycle development, co-dev, or external game art pipelines to increase velocity, especially when targeting multi-platform or GaaS structures.

Because the business model sets the foundation for every downstream decision, including monetization, roadmap planning, and game LiveOps services, it is one of the most critical early choices a studio makes.

Mobile game development follows different production dynamics compared to PC and console. Shorter iteration cycles, rapid content updates, and platform-driven constraints mean studios must choose a business model for mobile games that aligns with their resources and long-term goals.

Mobile teams commonly adopt:

Mobile titles like Clash Royale or AFK Arena rely on weekly or monthly updates, requiring strong LiveOps pipelines and sometimes external co-development teams to support continuous content delivery.

Many mobile studios keep core design internal but use co-development for engineering, game art pipelines, feature pods, and scaling LiveOps needs, especially during high-volume content cycles.

Hypercasual and creator-driven ecosystems (e.g., UEFN mobile experiences) allow faster prototyping and rapid publishing, appealing to smaller teams or studios exploring new verticals.

Choosing a mobile-first game development business model helps studios stay competitive in a market where speed, scalability, and LiveOps-readiness define long-term success.

Selecting the best business model for games is ultimately a strategic decision shaped by resources, timeline, team composition, and audience expectations. Studios often evaluate models using the following criteria:

If your internal team can’t cover all disciplines – engineering, art, design, UI, backend – full-cycle development or co-dev becomes essential.

Premium titles require heavy upfront investment, while Early Access, episodic, or publisher-funded models allow for staged production.

GaaS models demand ongoing features, updates, and LiveOps events. Premium titles need high polish at launch but fewer post-launch commitments.

Mobile demands rapid iteration; console and PC require long production cycles; ecosystem platforms reward fast experimentation.

Crowdfunding and self-funded Early Access offer full autonomy. Publisher-funded models come with milestone accountability and shared direction.

Hybrid production models allow studios to parallelize development by integrating external co-development teams into their pipeline.

By aligning these factors with your long-term vision, the right game business model becomes much clearer.

These specialized models empower game studios to scale efficiently across indie, mid-core, and AAA business structures by leveraging external expertise.

Modern studios rarely operate in isolation. As production complexity grows, external partnerships become critical to delivering consistent quality, predictable timelines, and long-term content support.

Best for: Premium, Early Access, Mid-core PC/Console, Indie AA

Full-cycle teams handle everything end-to-end – engineering, game art, design, UI, QA, optimization – making them ideal when studios need complete ownership and seamless execution.

Best for: GaaS, Hybrid, Ecosystem, Multi-platform games

Co-dev models allow internal and external teams to work side-by-side across features, modes, tools, art pipelines, and LiveOps updates. This is especially valuable for studios scaling up production without expanding permanent headcount.

Best for: GaaS, Mobile, Battle Pass-driven, Seasonal content

LiveOps specialists manage content updates, performance tuning, event planning, and analytics-driven iteration. Long-term LiveOps readiness is foundational to sustaining service-based game business models.

Best for: Premium, GaaS, Ecosystem, Hybrid production

Large content pipelines require continuous asset creation – environments, characters, UI, VFX. External art teams ensure visual consistency while accelerating delivery.

Each business model has unique operational needs, and choosing the right support structure is often as important as choosing the model itself.

The table below shows how well each business model aligns with common external support structures:

🟢 = Strong Fit

🟡 = Partial Fit

⚪ = Rare/Not Typical

| Business Model | Full-Cycle | Co-Dev | Game Art | LiveOps |

| Premium | 🟢 | 🟡 | 🟢 | ⚪ |

| GaaS / LiveOps | 🟡 | 🟢 | 🟢 | 🟢 |

| Early Access | 🟢 | 🟢 | 🟢 | 🟡 |

| Ecosystem (Roblox/UEFN/Meta) | ⚪ | 🟢 | 🟢 | 🟡 |

| Hybrid Production Model | 🟡 | 🟢 | 🟢 | 🟡 |

Even experienced studios encounter friction when selecting a production framework. The most common pitfalls include:

Avoiding these mistakes ensures your game business model remains realistic, sustainable, and aligned with your goals.

There’s no universal best business model for games – only the model that best aligns with your studio’s resources, goals, and production reality.

Your choice of game business model shapes everything – from production pacing to content cadence to how your team scales. Matching your model to your capabilities, timeline, and long-term vision gives your project the foundation it needs to succeed in an industry where scope, player expectations, and development cycles continue to rise.

If you’re evaluating the right approach for your next title or need support in building or scaling production, explore how our game development studio partners with teams worldwide through full-cycle development, co-development, LiveOps, and art production. Discuss your next project with us!

The most common gaming business models include:

Each game business model shapes how a studio plans, funds, launches, and supports games over time, rather than focusing only on how players are charged.

The business model for mobile games typically falls into a few clear structures:

These models directly influence content cadence, LiveOps investment, and decisions around external production or technology partners.

The best business model for games that need to scale is usually built around live service and ongoing content delivery. These models support:

Studios often pair these models with co-development or full-cycle external teams to expand production capacity without overextending internal resources.

Co-development and LiveOps operate as enabling layers within a game development business model, particularly for free-to-play and live service games. They help studios:

Rather than being standalone models, they reinforce and scale the core business structure.