Table of Contents

Imagine a country where 77% of the population are gamers and major cities host world-class esports events under dazzling lights. This is the reality of the United Arab Emirates (UAE) as it emerges as a gaming industry hotspot.

The United Arab Emirates is no longer just a stopover destination for business travelers and tourists—it has transformed into a pulsating digital arena where virtual battles draw millions of spectators, where teenagers become millionaires through mobile gaming tournaments, and where government-backed initiatives are building billion-dollar ecosystems that rival Singapore and China.

As 2026 unfolds, the UAE’s gaming industry is experiencing a metamorphosis that positions it as the most sophisticated and fastest-growing gaming hub in the Middle East, with projections that would make even Silicon Valley veterans take notice.

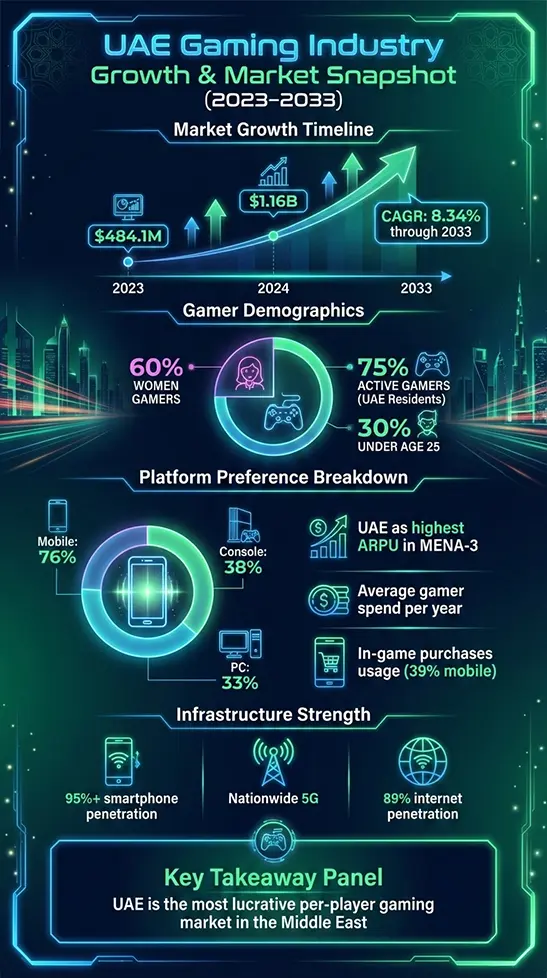

The UAE gaming market exploded from $484.1 million in 2023 to $1.16 billion in 2024, and is charging forward at an 8.34% CAGR through 2033. With 75% of residents actively gaming and smartphone penetration exceeding 95%, the Emirates has become the region’s most lucrative per-player market.

This blog explores what’s driving this explosive growth, the regulatory shifts opening new opportunities, and the emerging trends that position the UAE as the gaming capital of the Middle East, Africa, and South Asia.

Success in the UAE gaming market follows clear patterns. Here’s who’s winning and why:

Major global publishers are moving beyond tentative interest into serious market entry. Take-Two Interactive’s partnership with Advanced Initiative Company brought GTA V, NBA 2K, and Red Dead Redemption to legitimate UAE distribution channels. Tencent’s Level Infinite signed strategic partnerships in Qatar, while Sega and Savvy Games Group locked in approximately 15 deals throughout 2025. The formula is consistent: partner with local experts who understand regulatory requirements, cultural nuances, and payment infrastructure.

90% of the region’s gaming revenue flows through mobile platforms. Studios building mobile-first from day one outpace those treating mobile as an afterthought. Tamatem Games localized over 15 international titles into Arabic while building original franchises. Yalla Group created culturally relevant ecosystems beyond gaming. Spoilz combined cultural localization with sophisticated live operations. The pattern is clear: mobile-first studios scale faster, achieve better monetization, and build stickier communities.

Every successful entrant partnered with regional expertise rather than going solo. The GCGRA framework requires compliance from day one, and 57% of MENA gamers would stop playing games with culturally offensive content. Savvy Games Group’s 15 partnerships with Nintendo, Capcom, and Konami recognize that regional partners unlock regulatory access and cultural credibility that international studios cannot achieve on their own.

The gaming market in the UAE is growing at a pace that’s hard to ignore. Here’s what the numbers tell us:

| Metric | Value |

| Market Size (2023) | $484.1 million |

| Market Size (2024) | $1.16 billion |

| Projected Growth Rate | 8.34% CAGR through 2033 |

| Active Gamers | 75% of UAE residents |

| Smartphone Penetration | 95%+ |

| Internet Penetration | 89% |

The UAE has the highest Average Revenue Per User (ARPU) in the MENA-3 region (Saudi Arabia, the UAE, and Egypt). Each gamer in the UAE spends more money than gamers in neighboring countries, making it the most lucrative per-player market despite its smaller population.

High disposable incomes fuel in-game purchases and premium subscriptions, while exceptional digital infrastructure, including nationwide 5G coverage, ensures seamless gameplay. The tech-savvy population eagerly adopts new gaming technologies, from cloud gaming to blockchain-integrated platforms. Understanding game development cost structures becomes crucial for developers eyeing this lucrative market.

If you’re not focusing on mobile, you’re missing the biggest opportunity in the UAE gaming industry. The numbers prove it: 76% of UAE gamers prefer smartphones and tablets over traditional consoles. The average gamer spends 20-40 minutes daily on mobile titles, and 39% make in-app purchases regularly—higher than both console (38%) and PC gaming (33%).

The top genres dominating the mobile space include Action and Adventure, Sports and Racing, Battle Royale, and Casual Gaming. Popular games in the UAE include PUBG Mobile, Fortnite, eFootball PES, and Subway Surfers; these games consistently rank among the most-played titles, reflecting global trends with regional preferences.

The 5G revolution amplifies mobile gaming’s dominance. Cloud gaming services from Etisalat and Playkey.me let players enjoy console-quality games without the need for expensive hardware. This democratizes gaming, expanding the market beyond hardcore gamers to casual players seeking quick entertainment during their commute. For developers, mobile game development services are no longer optional—they’re essential for capturing market share in the UAE gaming market growth story.

In September 2023, the UAE established the General Commercial Gaming Regulatory Authority (GCGRA)—the nation’s first federal gaming regulator. This is huge for the gaming industry in the UAE.

The authority oversees four critical areas:

GCGRA doesn’t just regulate—it protects. Every licensed operator must implement:

The GCGRA is expected to issue its first commercial licenses this year, potentially including:

This regulatory clarity separates the UAE from regional competitors still figuring out their gaming laws. It also attracts serious investment from global gaming companies looking for stable markets.

The UAE’s regulatory clarity attracts global studios, but entry requires precision. Here’s the proven playbook:

| Strategy | Why It Matters |

| Partner with UAE-Experienced Companies | GCGRA licensing requires compliance infrastructure, regulatory relationships, and payment expertise. UAE-experienced studios compress approval timelines from months to weeks. |

| Start with Mobile or Live-Ops Pilots | 76% of UAE gamers prefer mobile. Launch MVP titles, test monetization, iterate quickly, then scale winners before committing to AAA budgets. |

| Localize Monetization & Compliance Early | GCGRA requires player protection features (deposit limits, cooling-off periods) built into platform architecture from day one—not bolted on later. |

| Avoid Banned Mechanics Before Submission | Conduct compliance reviews during pre-production. Identify controversial mechanics (loot boxes, gambling elements) and culturally adapt narratives early to avoid costly rejections. |

The UAE isn’t just talking about esports—it’s investing billions to dominate the sector. Abu Dhabi’s $1 billion esports island will be the Middle East’s first dedicated gaming metropolis, while Dubai’s annual Esports and Games Festival has become the regional tournament hub. The Games of the Future 2025, hosted at Abu Dhabi’s ADNEC venue, offers a $5 million prize pool and features innovative “phygital” competitions that merge physical and digital gameplay.

Local talent is proving the region can compete globally. UAE-based teams like Team Falcons are claiming international titles, demonstrating that infrastructure investment translates into competitive success. The Mubadala Investment Company’s partnership with Abu Dhabi Gaming shows sovereign wealth funds are serious about building a sustainable gaming ecosystem, not just chasing headlines.

The UAE’s strategic location between Europe, Asia, and Africa makes it perfect for hosting international tournaments with global audiences across multiple time zones. For studios looking to tap into this ecosystem, partnering with established game development companies provides crucial market insights and local expertise.

“Phygital” gaming blends physical sports with digital competition, and the UAE is pioneering this format. A football player’s actual performance on the field directly affects their team’s resources during a simultaneous FIFA match. A basketball player’s shooting accuracy unlocks power-ups in NBA 2K. This hybrid approach attracts traditional sports fans who wouldn’t normally watch esports, gamers who appreciate athletic skill, and sponsors seeking to reach both demographics simultaneously.

Abu Dhabi’s 2025 Games of the Future featured 13 hybrid disciplines with a $10 million total prize pool, drawing athletes from over 40 countries. The format’s success has secured multiple future iterations, with the 2026 Astana edition promising even larger stakes.

Beyond tournaments, the phygital concept is reshaping entertainment venues. VR Park Dubai integrates immersive gaming experiences into theme park attractions, while developers create AR-enhanced mobile games that overlay digital challenges onto Dubai landmarks like the Burj Khalifa. Working with an experienced game development company helps studios navigate the technical complexity of creating these innovative phygital experiences.

The UAE is positioning itself as the global hub for play-to-earn gaming, and the numbers back this ambition.

| Year | P2E Market Size | Growth Rate |

| 2024 | $1.5 billion | – |

| 2033 | $8.1 billion (projected) | 20.4% CAGR |

Regulatory clarity: The GCGRA explicitly accommodates crypto-integrated gaming services (with proper compliance).

Government support: Sovereign wealth funds actively invest in blockchain gaming studios.

Tech-savvy youth: Young Emiratis are eager to explore Web3 gaming models.

The key difference? Unlike many countries where crypto gaming exists in legal gray areas, the UAE provides clear rules that protect both players and developers.

While gamers focus on graphics and gameplay, artificial intelligence is revolutionizing the trends behind the scenes in the UAE gaming market. AI-powered personalization engines analyze playing styles to customize content recommendations, difficulty levels, and in-game offers. This drives higher engagement and better monetization—particularly crucial in the UAE’s high-ARPU market where each player represents significant revenue potential.

Procedural content generation using machine learning algorithms allows smaller studios to create massive, dynamic game worlds that compete with AAA titles. This democratizes development and fosters local creativity, reducing the barrier to entry for Emirati developers looking to build globally competitive games.

AI-driven anti-cheat systems and fraud detection have become critical for maintaining tournament integrity and P2E platform fairness, especially when real money is at stake. The GCGRA mandates sophisticated monitoring systems that leverage machine learning to detect suspicious patterns in real-time, ensuring fair play and regulatory compliance across all licensed platforms.

Successful games in the UAE gaming industry overview don’t just get translated—they’re reimagined for the local market. This goes far beyond Arabic-language interfaces and voiceovers. Culturally relevant storylines, characters that reflect regional values, and Islamic principles integrated into game mechanics make the difference between a game that sells and one that becomes a cultural phenomenon.

Content adaptation includes removing explicit content, incorporating halal financing mechanisms in economic simulation games, and even considering prayer times in live-service games. Developers must also be aware of banned games in the UAE, which typically include titles with excessive violence, gambling mechanics, or content that conflicts with Islamic values, ensuring their games meet regulatory approval before launch.

The business case is compelling. 60% of new MENA gamers are women, and 30% are under 25. This diverse demographic demands content that reflects their values and experiences. The UAE serves as the region’s localization hub, where global studios partner with cultural consultants to adapt content—a service many game development studio providers now offer as part of their comprehensive development packages.

Below are the gaming trends in the UAE that you need to watch out for in 2026:

| Trend | Impact | Opportunity |

| 5G Expansion | Low-latency cloud gaming | Reaching non-console owners |

| GCGRA Licensing | First commercial approvals | Legal clarity attracts investment |

| Phygital Events | Hybrid competitions grow | New audience demographics |

| P2E Integration | Blockchain gaming mainstream | Monetization innovation |

| AI Personalization | Smarter games | Higher player retention |

The gaming sector in the UAE faces real challenges despite the optimistic growth projections:

The UAE gaming industry stands at a defining moment as 2026 unfolds. The regulatory clarity provided by GCGRA, combined with billions in infrastructure investment, mobile-first market dynamics, and cutting-edge technology adoption across 5G, AI, and blockchain, creates a growth trajectory that exceeds even the most optimistic forecasts. The phygital revolution and play-to-earn blockchain integration offer differentiation strategies that set the UAE apart from regional competitors, while the cultural momentum making gaming mainstream opens doors to demographics that were previously skeptical.

Success hinges on execution. The GCGRA must transition from framework to active licensing without cultural missteps. Infrastructure projects must deliver ROI beyond headline figures. Local talent development must accelerate to reduce dependency on expatriate workers. If these challenges are met, the UAE won’t merely participate in the global gaming economy—it will shape its future. From hosting the world’s first phygital Olympics to pioneering regulated P2E ecosystems, the Emirates is positioning itself as the Silicon Valley of gaming for the Middle East, Africa, and South Asia.

For developers, investors, and entrepreneurs looking to capitalize on this explosive growth, the opportunity window is now. The market rewards those who understand regional nuances, regulatory requirements, and cultural expectations. Whether you’re building mobile-first experiences, esports platforms, or blockchain-integrated games, the UAE gaming market growth offers unparalleled potential for those equipped to navigate its unique landscape.

At Juego Studios, we bring deep expertise in the UAE gaming market, combining technical excellence with cultural understanding. As a leading game development studio, we’ve helped businesses transform gaming concepts into market-ready products that resonate with Emirati audiences while meeting international quality standards, positioning our clients for success in the region’s most lucrative gaming market.

Mobile gaming dominates because 76% of UAE gamers prefer smartphones, driven by 95% smartphone penetration, nationwide 5G coverage, and high in-app purchase rates of 39% among players.

The General Commercial Gaming Regulatory Authority (GCGRA), established in September 2023, is the UAE’s first federal gaming regulator, providing licensing frameworks and player protection standards for the industry.

Phygital games blend physical sports with digital gameplay, where real-world athletic performance directly impacts virtual game outcomes, pioneered through UAE tournaments like the Games of the Future.

Developers need partners who understand regional regulations, cultural localization, and technical requirements. Professional game development services help navigate GCGRA compliance, Arabic localization, and mobile-first strategies essential for UAE market success.