Table of Contents

Last year, a tabletop game about managing a fantasy tavern raised $15.1 million on Kickstarter. A cooperative pandemic survival game has generated over $13 million in lifetime sales. Meanwhile, a 90-year-old dice-rolling property game still outsells 99% of modern releases.

What separates these success stories isn’t just luck or timing—it’s strategic positioning within the different types of board games, categories that behave completely differently in the market.

The board game industry is experiencing explosive growth, projected to reach $34 billion by 2032, up from roughly $12-21 billion between 2024 and 2025. But here’s what most creators miss: not all game types are growing equally. Cooperative games are growing at 12.1% annually, while traditional competitive games are growing at 8%. Family games anchor 35-40% of the market but demand accessible pricing. Strategy games command 65% of the market share but face intense competition.

This guide breaks down the core types of board games, explains which categories are actually driving growth, and shows you how to position your design in a market where 80% of Kickstarter tabletop projects succeeded in 2025—but only when creators understood their category first.

When publishers classify games, they’re actually evaluating three overlapping dimensions:

Each choice pushes you toward different market segments, price bands, and distribution strategies. The most successful designs align all three layers intentionally.

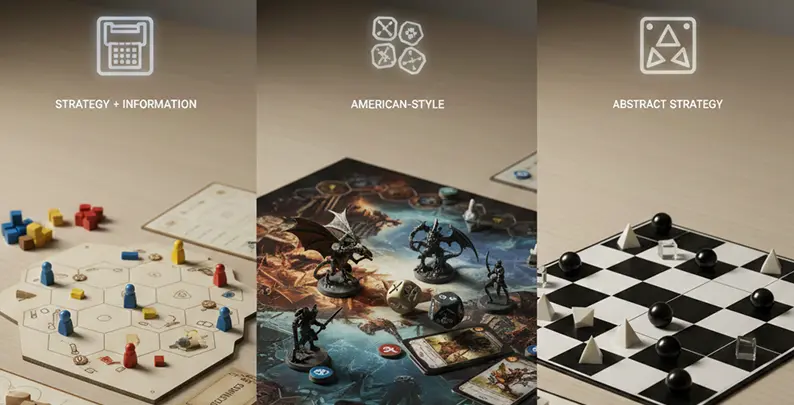

Before diving into mechanics, every board game exists somewhere on a spectrum between two design philosophies:

Eurogames prioritize elegant systems and strategic depth. They feature multiple paths to victory, minimal randomness, and indirect interaction—players compete for efficiency rather than eliminating opponents. Games like Agricola, Ticket to Ride, and Wingspan exemplify this approach.

The market data is compelling: Strategy/Euro games command 28.4% market share and dominate the adult strategy segment with higher price points ($40-100+) and strong long-tail sales. Whether you’re designing physical experiences or exploring board game development services for digital adaptations, Euros represent proven demand with established player literacy.

American-style games embrace narrative, dice combat, and cinematic moments. Player elimination and dramatic swings are features, not bugs—the appeal is emotional highs rather than perfect balance. Zombicide, Arkham Horror, and even Monopoly fall here.

These games thrive on miniatures, expansions, and IP partnerships, making them well-suited to crowdfunding. They celebrate chaos over optimization, creating memorable moments through unpredictability.

Abstract games feature minimal theme, perfect information, and little luck. Chess, Go, Azul, and Onitama represent this category. While evergreen, they occupy a niche from a growth perspective—ideal for boutique lines and educational positioning rather than mass-market expansion.

Most modern games blend mechanics, but treating one as “primary” and others as “supporting” clarifies your market position. Understanding these most popular game genres helps publishers allocate resources strategically.

Players place tokens on board spaces to claim actions and resources. Dune: Imperium and Agricola excel because each placement creates opportunity cost. This flagship mechanic of strategy/Euro games performs strongly with enthusiasts and offers natural replayability through variable board setups.

Players start with weak cards and purchase better ones to improve their personal deck during play. Dominion pioneered this; Gloomhaven modernized it for campaign experiences. This mechanic drives premium pricing and is ideal for expansion-driven product lines since collectors build multiple deck variations.

All players win or lose together against the game system. Pandemic proved players don’t just tolerate cooperation—they crave it. This category now represents one of the fastest-growing segments at 12.1% annual growth, especially when combined with legacy elements or app support.

Games that permanently alter components across multiple sessions through stickers, sealed envelopes, and branching stories. Pandemic Legacy, Gloomhaven, and Clank! Legacy command premium prices ($60-100+) and generates exceptional buzz because each playthrough tells a unique, unrepeatable story. These are crowdfunding gold.

Players compete to dominate board regions for points. Risk, Root, and El Grande showcase this mechanic. Visual tension on the board makes area control attractive for both hobbyists and café play, where spectators can instantly understand who’s winning.

Players position tiles to build maps, patterns, or networks. Carcassonne, Kingdomino, and Cascadia demonstrate this family-friendly mechanic. Easy to teach and strong for mass retail, tile-placement games offer surprising depth beneath their accessible rules.

Hidden roles, bluffing, and table talk define games like Codenames, The Resistance, and Secret Hitler. Low component costs, high virality, and 6-10 player counts make these ideal for café play and casual buyers. Party games grow at 7-10% annually and benefit from post-pandemic social hunger.

The target audience transforms “type” from a design question into a business decision. Two games with similar mechanics can live in entirely different markets.

The foundation of the industry: 2-6 players, 30-60 minutes, simple iconography, and approachable rules. Ticket to Ride, Catan, and Kingdomino dominate here. This segment holds 35-40% of market share, grows steadily at 6-8% annually, and shows resilience during economic downturns. Price point: $25-50.

Deeper rulesets, longer playtimes (90-180 minutes), and premium pricing ($40-100+). Terraforming Mars, Spirit Island, and Ark Nova exemplify this segment, which commands 65% of market share. This is where most Kickstarter hits live and where mature competition demands exceptional design execution.

Large player counts (6-12+), minimal setup, and emphasis on laughter or tension. Codenames, Wavelength, and Just One thrive here. Ideal for cafés, bars, and casual buyers who prioritize accessibility over strategic depth.

Age-banded designs (4+, 6+, 8+) with shorter sessions and clear learning outcomes. Strong for schools, libraries, and parent-driven purchases. This segment grows at 6-7% and remains stable across economic cycles.

Designed to be satisfying alone with optional multiplayer. Spirit Island, Final Girl, and Hadrian’s Wall lead this emerging category. Solo board gaming exploded in 2024-2025, and entering 2026, solo mechanics are design anchors rather than afterthoughts. Games offering both multiplayer and deep solo experiences command premium pricing and justify higher retail prices.

The data reveals where momentum is building:

| Segment | Market Share | CAGR | Characteristics | Key Games |

| Adult Strategy | 65% of total | 8% | Complex mechanics, high replayability, premium pricing ($40-100+) | Terraforming Mars, Everdell, Dune: Imperium |

| Family Games | 35-40% | 6-8% | Accessible rules, 30-60 min play, $25-50 price point | Ticket to Ride, Catan, Splendor |

| Party Games | Growing | 7-10% | 4-12+ players, 30-90 min, social focus | Codenames, Wavelength, Jackbox |

| Cooperative | Growing | 12.1% | Shared victory, narrative arcs, emotional investment | Pandemic, Gloomhaven, Forbidden Island |

| Legacy/Campaign | Emerging | 12.1% | Multi-session, permanent changes, story-driven | Gloomhaven, Risk Legacy, Pandemic Legacy |

| Educational/Kids | Stable | 6-7% | Cognitive development focus, age-appropriate mechanics | Splendor Junior, Ticket to Ride: Nordic Countries |

Critical insight: The data reveals a critical insight: cooperative and legacy games are the growth engine, expanding 50% faster than traditional competitive games. Yet they represent only 12% of the market—suggesting substantial upside for publishers who master narrative-driven, collaborative design.

Adult strategy games command 65% of the market share but grow at the market rate (8%), indicating maturation. Family games, while growing more slowly, account for 35-40% of volume and show resilience during economic downturns. Party games remain volatile but benefit from post-pandemic social hunger. Understanding these most popular game genres helps publishers allocate resources strategically across development and marketing.

Kickstarter’s 2024 numbers fundamentally reshape creator strategy:

Crowdfunding is no longer a niche workaround—it’s the primary route to market for indie creators. It validates demand before manufacturing, builds community investment, and delivers immediate cash flow exceeding traditional retail launches.

Strategic implication: Your game must fit crowdfunding-friendly categories. Cooperative games, legacy experiences, and games with stunning artwork perform 20-40% better on platforms than abstract strategy or traditional roll-and-move designs. Partnering with an experienced game development agency can accelerate your path from prototype to funded campaign.

Board game cafés have evolved from niche experiment to mainstream entertainment destination. Young adults aged 21-35 are seeking offline social experiences as antidotes to digital fatigue. Modern cafés curate 250+ game libraries, employ specialized game hosts, and run themed tournaments and corporate events. For publishers, this means games designed for 4-8 players with 45-90 minute play times perform significantly better in café settings, creating permanent demand drivers through weekly trial and word-of-mouth marketing.

Digital integration has shifted from gimmick to expectation for complex games. Apps like Gloomhaven Helper and Mansions of Madness now handle computational overhead, enable intelligent AI opponents for solo play, and enhance narrative through augmented reality—all while keeping the focus on tactile gameplay. The key: apps should be silent servants, present but unobtrusive. Choosing the best game engines for companion app development can make the difference between seamless integration and clunky execution. Publishers integrating apps thoughtfully see substantially higher session frequency, while those treating digital as an afterthought lose player engagement.

Solo board gaming exploded in 2024-2025, and entering 2026, solo mechanics are design anchors rather than afterthoughts. Games like Spirit Island and Final Girl succeed by delivering emotionally satisfying experiences with automated opponents and narrative progression. Solo modes now command premium pricing—games offering both multiplayer and deep solo experiences justify higher retail prices. Publishers are competing indirectly with narrative video games for leisure time, making story-driven design and player agency critical differentiators.

The playbook for new creators aligns all three type dimensions:

First, define your primary mechanic and understand how secondary layers add depth without confusion. A worker placement game can incorporate deck building (Dune: Imperium does this brilliantly) to increase strategic options.

Second, choose your segment intentionally based on resources and goals. Adult strategy games face higher competition but command better margins. Family games benefit from holiday seasonality and broad retail access. Cooperative games grow faster but require stronger narrative design.

Third, if targeting adult, cooperative, or legacy segments, plan for crowdfunding as your primary launch strategy. Traditional retail is increasingly inaccessible for indie creators.

Finally, design for community play. Games that work well in café settings and support 4-8 players create word-of-mouth marketing that compounds over time.

The board game market isn’t growing because games are new—it’s growing because games solve something digital experiences can’t: synchronous, embodied, social engagement. A family playing a legacy campaign over three months creates memories. A strategy club meeting weekly builds community.

Your game’s success depends less on mechanical novelty and more on honest positioning within proven segments. Cooperative narratives are entering a high-growth segment where emotional resonance commands premium prices. Worker-placement designs face mature competition but benefit from established player literacy.

The data is clear: players aren’t craving radical reinvention. They’re craving games that respect their time, deliver consistent engagement, and create moments worth gathering for.

The next $15 million Kickstarter is already in someone’s design notes. Know your category, design within its conventions, and execute with craft. That’s how ideas become sensations.

Board games fall into two philosophical categories: Eurogames (strategy-focused with minimal luck) and American-style games (theme-driven with dice and conflict). Within these, core mechanics include worker placement, deck building, cooperative gameplay, legacy games, and area control.

Cooperative and legacy games lead growth at 12.1% annually, 50% faster than traditional competitive games. Solo-play designs and narrative-driven experiences are also expanding rapidly as they compete with video games for leisure time and command premium pricing.

Games with cooperative mechanics, legacy elements, stunning artwork, and 4-8 player scalability perform 20-40% better on crowdfunding platforms. In 2024, 80% of tabletop Kickstarter projects succeeded, with proper category positioning being the key differentiator for funded campaigns.

Board game cafés generate permanent demand through weekly trial and word-of-mouth marketing. Games designed for 4-8 players with 45-90 minute play times perform significantly better in café settings, extending shelf life beyond initial purchases and creating sustained retailer reorders.

Game development outsourcing allows board game publishers to access experienced developers at flexible budgets, transforming prototypes into market-ready digital products without maintaining full-time internal technical teams.